This article features the evolution of the hardware side of tablets. The software side of tablet products and technology related to multitouch interfaces is profiled in the article Inside the multitouch FingerWorks tech in Apple's tablet .

The new "iSlate" or perhaps "iBook" product that observers hope to see from Apple is thought to include a new graphical interface based on the multitouch foundation of the iPhone, and is anticipated to physically fit between the pocket-sized form factor of the iPhone and iPod touch and the 13-inch notebooks of Apple's Mac lineup.

A variety of vendors have tried to deliver tablet-like products over the past two decades, but none have been a standout success. This has the tech world watching with bated breath to see if Apple can apply its aura of desirability to the tablet segment in the same way that it has managed to do in desktops, notebooks, MP3 players and smartphones.

Looking at the history of tablet products of the past provides some clues as to why they haven't taken off yet, and what new potential they might have this year, given the new advances in hardware technology and the platform advancements that have stoked a software market capable of supporting users' interest in such a device.

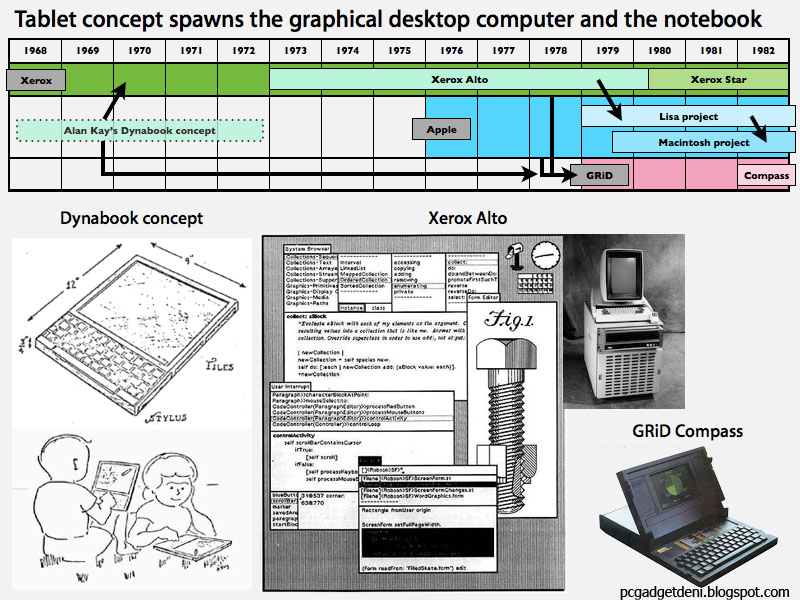

Early tablet ideas: 1968 - 1982

The concept of handheld computing got started in the late 60s, when Alan Kay met with other graduate students to demonstrate his FLEX Machine system. At the event, Kay saw the first working flat panel display, which led to the idea that at some point the technology would exist to embed a personal computer (already a novel idea) into a flat panel display to deliver a very personal mobile device.

Kay's idea mingled with his interest in promoting computers as a tool in primary education, resulting in the "Dynabook" as a product vision that would enable not just dynamic books, but also fuel changes in how individuals related to computers. Kay originally envisioned a two pound device with a keyboard and a megapixel display.

Kay brought his ideas to Xerox PARC in 1970, where they morphed into the desktop Alto prototype system that Kay called an "interim Dynabook." The Xerox Alto dramatically advanced the state of the art in computing by fusing a variety of brilliant ideas, including Douglas Engelbart's pioneering concepts related to mouse-based graphical computing. The advanced research at Xerox greatly influenced Apple's Lisa and Macintosh projects, which brought intuitive desktop computing ideas from the lab to mainstream users.

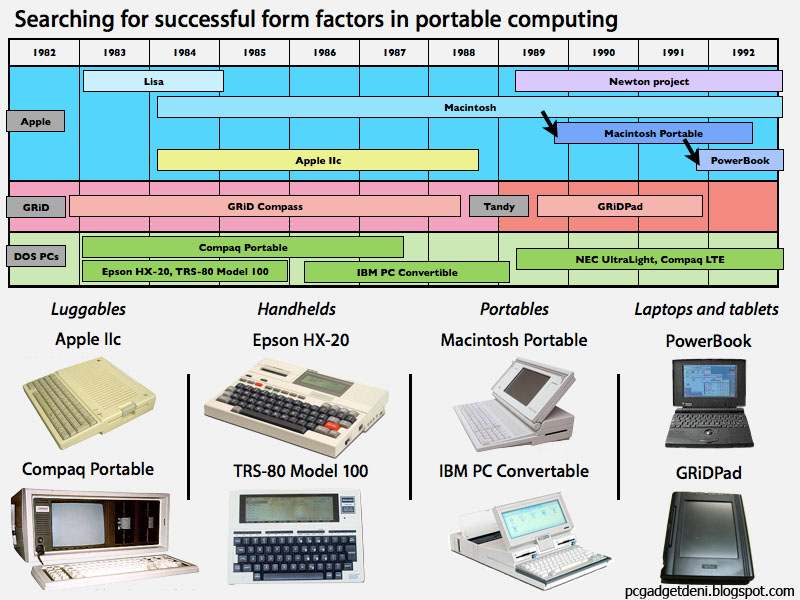

Tablets wait through the age of notebooks : 1982 - 1991

The goal of taking the technology demonstrated by the Alto and shrinking it into a Dynabook-sized tablet remained a futuristic vision throughout the 80s. Various PC companies brought new portable personal computer designs to market, starting with suitcase-sized luggables which required an AC plugin, and progressing to battery powered handheld systems and increasingly thin and portable notebooks; these were all largely text-oriented DOS computers. The closest thing to a tablet that the available technology allowed were handheld systems dominated by a full keyboard, with a small LCD readout suppling a few lines of text.

GRiD, founded in 1979 by Xerox executive John Ellenby and Dave Paulsen of Apple, introduced its Compass as the first commercial notebook computer in 1982 with a hinged, 320x200 display that folded shut over the keyboard. It cost $8,150, or about $17,900 in today's money. GRiD's portable computing product attracted the attention of national security and intelligence groups in government as well as corporate executives; NASA regularly took the portable Compass into space.

Apple didn't bring its graphical Mac Portable to market until 1989. By that time, DOS PC notebook vendors had delivered an impressive array of models designed primarily for text-based computing (Toshiba even branded its PC notebooks as "Dynabook" in homage to Kay's original ideas), and a couple companies (including Outbound) even launched portable systems that ran the graphical Macintosh operating system using ROM chips from retired Apple computers.

The conventional notebook design won out over tablet-sized systems in popularity, simply because the notebook provided the most ideal combination of portability, computing power and screen real estate. Apple's first foray into mobile computing with the Mac Portable was taxed by its need to pack significant processing power and a high quality 640x400 display suitable for supporting its graphical computing environment. However, by 1991 Apple had teamed up with Sony to shrink its mobile Mac into a thin notebook form factor called the PowerBook. The new model shifted the keyboard back toward the hinge, making room for a palm rest equipped with a trackball for navigating around windows on the screen, a convention followed by nearly all notebook makers since.

Over the next decade, Apple maintained a leading position among top notebook makers, but eventually began to fall behind the curve as the company's outlook grew questionable. At the same time, Apple began working on an even more portable device to be sold as a companion device for desktop and notebook users: the Newton Message Pad.

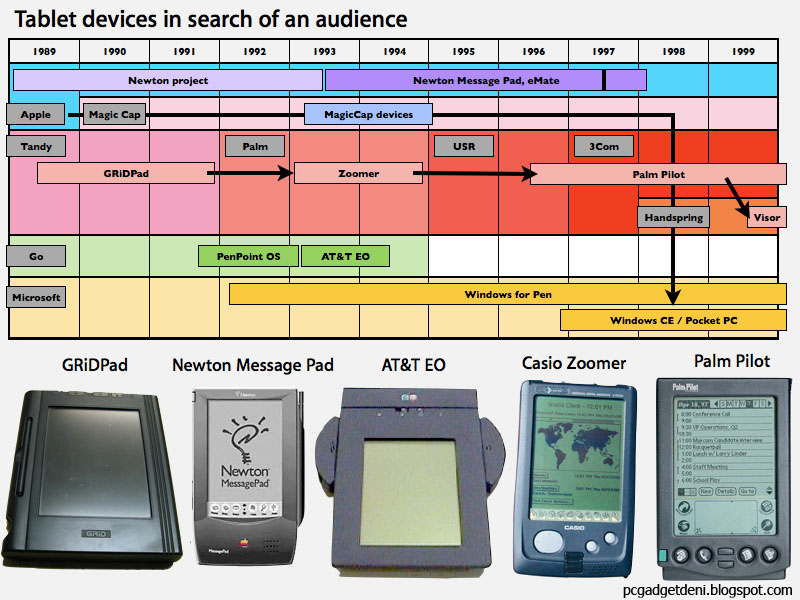

Birth a new wave of tablets : 1989 - 1994

As notebooks entered the mainstream as a conventional design for marrying a keyboard and screen, mobile pioneers worked to make computing even more personal with handheld tablet devices piloted by a stylus. GRiD had patented the notebook concept of hinging a flat panel display over the keyboard, so it earned enough money from patent licensing royalties to weather the shift toward DOS compatibility (GRiD's pioneering notebooks ran their own proprietary operating system), at least until 1988 when the company was sold off to Tandy. After that, many of the groups luminaries began to leave for other companies.

That included Jeff Hawkins, who had joined GRiD in 1982 and later served as its vice president of research. Inside GRiD, Hawkins had worked with Samsung to develop a thick table-sized device called the GRiDPAD that ran DOS with a stylus on a 640x400 screen for about 3 hours before the battery died. It cost $2,370 in 1989, or about $4000 in today's currency.

Hawkins saw significant potential in targeting consumers with a simpler, cheaper and more practical device, so he floated the concept of the "Zoomer" to Tandy, a project which the company wasn't interested in completing by itself. That led him to license GRiD's software and develop the product in a spinoff named Palm Computing in 1992, where he was joined by Apple alumni Donna Dubinsky. Palm produced the Zoomer with Tandy, which brought in Casio to manufacturer it.

Around the same time, Go Corporation delivered the PenPoint OS as one of the first operating systems specifically designed for handheld systems. PenPoint presented an interface following the metaphor of a tabbed notebook, aiming to be simple and easy to use. Go licensed PenPoint to various companies, including GRiD.

AT&T released its short-lived EO Personal Communicator running the PenPoint OS in 1993. Two wireless models were priced at $2000-$4000. The project ran out of funding and went under just a year after its launch. The demise of Go as an operating system vendor was largely attributed to the threat posed by Microsoft’s Windows for Pen Computing, which promised to eat up the entire market for pen based tablets and PDAs by simply adding some extra pen-savvy software to the Windows PC, enabling PC makers to deliver tablet designs without really investing in their own research and development.

Windows for Pen was ultimately unsuccessful in finding an enthusiastic audience, but it did allow Go Corporation executives to later sue Microsoft for both patent violations and alleged theft of technology that GO had demonstrated to Microsoft under NDA.

Apple's Newton: 1993 - 1998

By the time the EO and Zoomer reached the market in 1993, Apple was finishing its own entry into the tablet market with its Newton Message Pad. That device was the result of years of work to apply Apple's core competencies in platform development and software interfaces to the mobile realm. While the Zoomer was marketed to consumers, Apple's Newton platform was more broadly floated as a way to do lots of things. Unlike the broadly licensed PenPoint and Windows for Pen however, Apple planned to deliver Newton on its own as an integrated product.

Beginning around the Knowledge Navigator concept in the late 80s, Apple had been working for years on how to deliver the next major computing platform, which was widely anticipated at the time to be a pen-driven tablet device. Apple invested in developing a suitable mobile processor with Acorn, creating the ARM partnership that today delivers the vast majority CPUs for mobile and embedded applications. It also worked to develop a completely unique user interface and new development tools. The company's CEO, John Sculley, debuted a Newton prototype at the Consumer Electronics Show (CES) in 1992, coining the term "personal digital assistant" to describe it.

The Message Pad reached the market in late 1993 at about the same $700 price tag as the Zoomer, but with far more advanced technology that killed any prospects for Palm's Casio-built device. That reoriented Hawkins' company toward developing Newton software; Palm created the Graffiti input system to make stylus-driven handwritten recognition easier and more accurate.

On the other side of the early 90s tablet spectrum, AT&T's wireless EO carried a $2000 to $4000 price tag (that's equivalent to about $2900 to $5800 today), which priced it well out of the market for most consumers. Microsoft's Windows for Pen also failed to gain any traction. Apple's Newton failed to attract buyers in the volumes that had been anticipated, leaving the company to radically dial back its investment in the new mobile platform.

Parallel to Newton, a competing tablet-related project within Apple called Paradigm was spun off in 1990 to become General Magic. Unlike Apple's original strategy for Newton, General Magic intended to broadly license its operating system to a variety of hardware makers. Sony, AT&T and Motorola were partners and investors in the company, and each of them brought Magic Cap devices to market in 1994. Apple embroiled itself in lawsuits with General Magic, and by 1998 the struggling company had licensed its technology to Microsoft.

The second wave of tablets: 1997 - 2002

The bitter series of disappointments related to tablet products and "pen computing" in the early 90s dampened interest among consumer electronics companies investigating in launching similar devices. Hawkins hadn't given up on the concept however.

His third attempt at a handheld PDA was launched as the $300 Palm Pilot in conjunction with US Robotics in 1996. By that time, Apple was in deep trouble and its Newton didn't seem to have much future as an Apple-exclusive platform. The Pilot's revolutionary price point attracted lots of attention, which helped result in a resurgence of interest in tablet devices at both Apple and Microsoft.

Apple's then CEO Gil Amelio, charged with the daunting task of turning the faltering company around, both acquired Steve Jobs' NeXT, Inc. and kicked off plans to license the Newton OS and spin off the mobile platform as an independent subsidiary. Following the debut of a faster new generation of Newton 2000 Message Pads and eMate devices in early 1997, Amelio launched Newton Inc., only to see Jobs effectively remove him from power and reabsorb the brand new Newton spinoff just weeks afterward.

Rather than killing the Newton, Jobs said he thought the Newton platform would have a better chance at success within Apple than it would having been spun off as its own company and attempting to work with other hardware licensees. Jobs returned to the spotlight at Apple by presiding over a second product refresh of the Message Pad that was unveiled next to the new PowerMac G3 that fall.

Apple had found a route out of failure, but it was still in danger. After the new Newton models failed to register any significant sales, Jobs announced that Apple would be canceling the entire project and discontinuing all future tablet development to focus on Apple's core strengths in Mac desktops and notebooks; that termination occurred in early 1998.

Hawkin's Palm Pilot had helped fuel new interest in PDAs but also helped to destroy any potential for Newton's success because it effectively ate up all the low hanging fruit, leaving Apple with just the sophisticated high end, a niche market that simply couldn't sustain the development required to maintain such a complex product. At the same time, Microsoft had been working to migrate its mid-90s Windows CE "Handheld PC" concept into a device more like the Palm Pilot, initially calling its new PDA the "Palm PC" until Palm sued Microsoft to force it to come up with an original name: Pocket PC.

When the Dot Com collapse occurred in 2000, the imagined market for PDA executive toys largely evaporated, leaving the rival PDA products from Palm and Microsoft contending for a much smaller market than either had planned to service. Apple was no doubt relieved that it had exited the market a couple years prior.

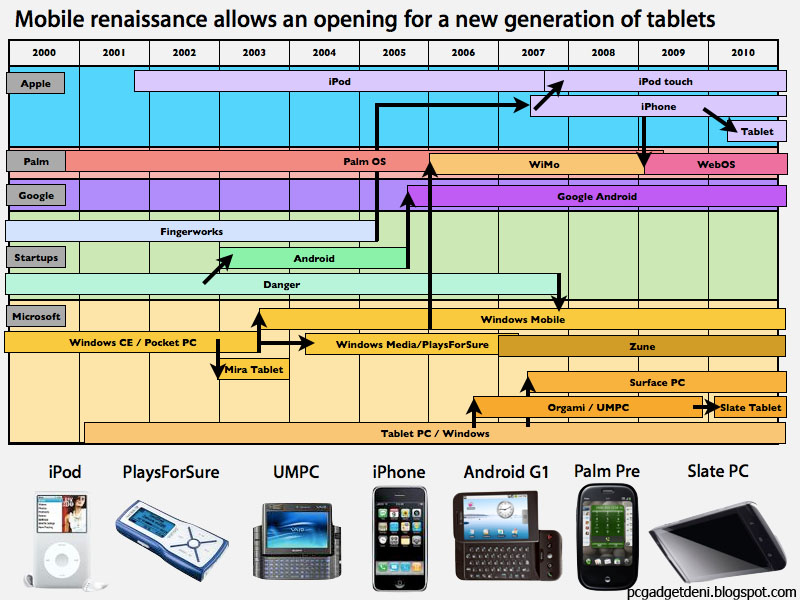

The rise of mobile devices: 2001 - 2009

Microsoft co-founder Bill Gates initially hoped to shift the remaining interest in mobile devices to a new category of modified laptops with stylus input. The Redmond, Wash.-based software giant called the new product the Tablet PC, which Gates introduced in 2001 along with the prediction that everyone would be using Tablet PCs as their primary computer within just a few years. Tablet PC was a lot like Windows for Pen from the previous decade: a reference design that allowed hardware partners to create tablet devices without really trying, simply by bundling Microsoft's operating system. It did not fare much better.

Apple introduced a much more narrowly focused mobile product later that same year: iPod. Meanwhile, Hawkins had left Palm to develop Handspring as a PDA maker with more creative flexibility. Handspring happened upon pairing the PDA with a cellular phone module to create a new generation of smartphone. That caught the attention of Palm, which acquired Handspring and refocused itself from making PDAs toward the new Treo smartphone that Hawkins' group had developed.

Palm's smartphones were rivaled by Nokia's Symbian devices (which had similarly grown from PDA roots), the new BlackBerry smartphones from RIM (which had evolved from that company's pager business), and Microsoft's new Windows Mobile initiative, which had similarly hoped to salvage the company's investments in making PDA devices and apply them toward the vast new potential in smartphones. After a brief period of leadership, Palm lost control of the smartphone market that it had helped to create, and eventually resorted to licensing Microsoft's Windows Mobile in 2006.

During the same decade, Microsoft also hoped to leverage its Windows CE PDA operating system under the Windows Media brand to take on Apple's blockbuster success with the iPod. Windows Media fared poorly against the iPod, adding failure on top of the Tablet PC initiatives that churned out generation after generation of tablet devices that never gained any significant traction in the market.

Apple continued advancing the iPod and iTunes until 2007, when it debuted the iPhone as its own concept for a smartphone. That year, Microsoft grew increasingly concerned as it realized that Apple's iPhone would leverage the success of the iPod to potentially rival its own Windows Mobile smartphone platform, which had been flickering hints of future promise among an otherwise dark outlook for its mobile and consumer offerings.

Before Apple introduced the iPhone, the threat of a successful mobile operating system controlled by Microsoft was enough to compel Google to enter the smartphone business in a defensive effort to keep the market open for mobile ads and paid search results. Google purchased Android in 2003 and continued work on the effort to rival Microsoft until debuting it in 2007 in the wake of the iPhone.

Over the first three generations of the iPhone, Apple broadened the new platform into a new iPod touch model and built a solid array of third party developers around its new smartphone platform. Engineers who were worked to the bone within Apple left to help design a new device at Palm. That company's original Palm OS had failed along with its strategy to license Windows Mobile; both were scuttled once the company's new WebOS was introduced in 2009 running on the Palm Pre.

Google's Android efforts have helped kill off Microsoft's intended market for a paid mobile operating system, much as the cheap Palm Pilot had helped prevent Apple's Newton from going anywhere. In smartphones, Nokia's shrinking plurality of market share is being rivaled by Apple's iPhone, RIM's BlackBerry family, Google's Android platform, and to a smaller extent, Palm's WebOS, the remains of Windows Mobile, and some new entries into the arena including Samsung's Bada platform and HTC's new BREW devices.

That intense competition is widely expected to whittle the array of platforms down to a few winners, at least according to most pundits. It may also be that a healthy number of rival operating systems can coexist while posing little problem for consumers, given how little mobile software costs. Among PCs in the 80s and 90s, compatibility with third party software titles (and the operating system they depended upon) was a much bigger issue for users. Today, there does not seem to be many significant barriers stopping consumers from trying a new smartphone platform. Many people carry both a BlackBerry and an iPhone, for example, or have moved from Windows Mobile or the Palm OS to a modern smartphone without worrying about losing their software investments in the prior platform.

Return of the tablet: 2010

After three blockbuster iPhone launches, each followed by a successful iPod touch introduction, observers naturally began to wonder how Apple would expand its new mobile device franchise. Over the previous decade, Apple engineers built a series of prototype devices that were all rejected, ranging from mini notebooks to a tablet Web browser (which ended up being incorporated as the Mobile Safari app used in the iPhone). Steve Jobs even noted that one of the things he was most proud of was resisting the desire to launch a new tablet device without first putting into place the ecosystem needed to sustain it.

Launching a tablet product, even with impressive hardware features, is almost certainly doomed to failure unless it is delivered with a ready audience willing to support it. A major problem for the Newton was that Apple simply threw the product at the market as a toy with incredible potential. It didn't do enough out of the box to warrant buying one. That left zero potential for ever building a critical mass needed to attract the very third party development that was needed to make it worthy of buying.

A similar problem plagued the Zoomer and the EO. On the other hand, the Palm Pilot was practical and useful even without ever installing apps, which both contributed to its user base and helped pique the interest of developers. Microsoft's Tablet PC wasn't a very practical product without third party software, which certainly worked against its popularity. And, of course, the iPhone also shipped fully functional; for its first year it stood on its own merits without even having an official mechanism for installing additional software.

Conversely, hype alone hasn't yet stoked blockbuster interest in either the WebOS-based Palm Pre or in Google's Android phones, leaving their third party software options limited and subsequently suppressing the financial reasons for developers to get involved in changing that situation. Google's official plan is to simply push out enough Android phones to reach critical mass, but no model has yet delivered sales worth bragging about, and nearly every new introduction adds hardware features that make it more difficult for developers to deploy software that works seamlessly across all Android devices.

At and around this year's CES, a variety of manufacturers debuted hardware tablet devices with unclear primary functions and limited utility out of the box. Apple's expected tablet won't have that problem because the company already has the attention of developers in iPhone and iPod touch development, and is reportedly working with its software partners to adapt their existing mobile applications to the new tablet's screen and user interface.

If successful in launching its new tablet design, Apple will also be insulated from imitation, as its software infrastructure is closely tied to its own software platform and can't realistically be adapted to support hardware clones (just as no other smartphones can run iPhone apps). And given that Apple will be marketing its tablet to iTunes, Mac, iPhone, and iPod touch users, the company's competitors will all need to set up their own iTunes-equivalent or work out from scratch how to sync their new device with users' PCs and smartphones.

That's a daunting task that has stymied Palm's WebOS and similarly forces Android users to rely on cloud sync. It's a tall order even for major manufacturers like Sony, which was completely flummoxed when trying to compete against the much simpler iPod. How will vendors respond to Apple's tablet announcement? The remains of 2010 should offer an exciting look at whether tablet devices have the potential to become an important product among consumer electronics, and what companies will benefit from any growth that occurs.

No comments:

Post a Comment